Content

- federal bureau of investigation

- “The biggest thing I got from it was learning the value of time and how we often squander it,” the actor said

- For Tax Evasion or Tax Fraud, Prison Can Follow

- Should You Plead Not Guilty?

- Fraud Indicator: Omission of an entire source of income.

- How Do You Get in Trouble for Tax Fraud?

- Jail Time and Other Penalties for Tax Evasion

If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply.

Michigan Real Estate Developer Sentenced to Prison for Tax Evasion – Department of Justice

Michigan Real Estate Developer Sentenced to Prison for Tax Evasion.

Posted: Tue, 11 Oct 2022 07:00:00 GMT [source]

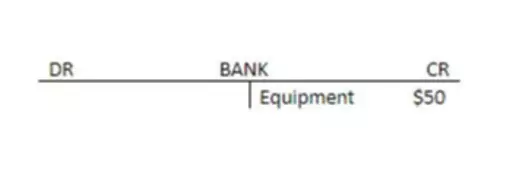

When the auditor asks for copies of all of John’s bank records for all accounts for 2013, John gives the auditor only his primary checking account and says there’s no other account. John tells the auditor that his only income was from his firefighter job. The auditor also asks John whether he received any other funds (like gifts, loans, inheritances, etc.) for 2013. John repeats that he earns money only from his firefighting job and hasn’t received any other income or funds during the past five years. We’ve called out the fraud indicators the IRS looks for as proof of tax evasion.

federal bureau of investigation

You may also be liable to pay financial penalties in addition to serving time. The criminal history of the defendant also plays a major role in determining how long they’ll be spending in jail. The sentencing guidelines are based on the policy that repeat offenders should be given a harsher sentence. It’s pertinent to note that these guidelines are “advisory” and the presiding judge has the authority to sentence the defendant above or below the range provided by the guidelines. The guidelines have 43 levels in total that represent the seriousness of the offense. As a rule of thumb, keep in mind that the more serious the crime, the higher the base level is going to be.

Get the facts from the tax experts at H&R Block. Learn about the consequences and complications of an unflied tax return from the experts at H&R Block.

“The biggest thing I got from it was learning the value of time and how we often squander it,” the actor said

On this return, he also did not report his income from promoting the scheme. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules.

Torrio retired in 1925 after an attempt on his life and Capone, known for his cunning and brutality, was put in charge of the organization. Prosecutors in Barcelona have alleged the Grammy winner spent more than half of each year between 2012 and 2014 in Spain and should have paid taxes in the country. While awaiting the results of appeals, Capone was confined to the Cook County Jail.

For Tax Evasion or Tax Fraud, Prison Can Follow

While it seems a straightforward scam, this tax crime usually involves multiple charges. As the subject of an IRS criminal tax investigation, Mr. Propstra faced numerous allegations. In addition to failing to pay over the monies he collected from his client companies, Mr. Propstra filed false income tax returns stating he paid more taxes than he had. Then he quit filing employment tax returns altogether and disposed of filing accurate wage reports to the Social Security Administration. For his own group of small businesses, Mr. Propstra failed to pay over $710,819.05. Statistically speaking, the chances of any given taxpayer being charged with criminal tax fraud or evasion by the IRS are minimal. The IRS initiates criminal investigations against fewer than 2 percent of all American taxpayers.

Gerard Piqué, Shakira’s partner of more than a decade and father of her two children—from whom she announced a split in June—plays soccer for FC Barcelona. The other option is an Offer-in-Compromise, which is essentially an agreement between the taxpayer and the IRS to settle tax liability for a fraction of the entire amount that is owed. You will most likely Who Goes to Prison for Tax Evasion? not have this option when the IRS has reason to believe that you can pay down your tax debt with a monthly payment plan. For a tax crime to be classified as tax evasion, it must involve the use of illegal methods to conceal income or information from the IRS. Tax fraud is committed when you willfully avoid your legal obligation to pay income taxes.

Should You Plead Not Guilty?

Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. Many people are afraid of IRS audits — and maybe even going to jail if they make a major mistake. In fact, fear of an IRS audit is one of the main reasons that people strive to file timely and accurate tax returns each year. Contact Grewal Law PLLC to serve as your white collar criminal defense lawyers in Michigan. Our experienced tax attorneys understand federal tax codes and state law related to tax evasion and can use their knowledge to assist you. TheInternal Revenue Service will go after you for tax evasion when you fail to report money you earned on your taxes or simply do not file a federal return.

John didn’t receive either of these statements because he moved in early 2014 and didn’t change his address with the bank or ABC Builders. John Doe is a firefighter and works one 24-hour shift every fourth day. During his off hours, he has developed a lucrative plumbing side business. This leaves John with a good primary source of income, health and retirement benefits, and, mostly, a lot of extra time to earn more money. Capone was at the top of the F.B.I.’s “Most Wanted” list by 1930, but he avoided long stints in jail until 1931 by bribing city officials, intimidating witnesses and maintaining various hideouts.

Fraud Indicator: Omission of an entire source of income.

After preparing 13 false tax returns that claimed millions in refunds from the IRS, a Maryland accountant was sentenced to three years in prison and one year of supervised release. It’s important to note that the clock doesn’t start ticking until you file your return. If you owe the IRS on a 10-year past due return that you never filed, you can still be charged with tax evasion. If you happened to file a return ten years ago but never paid the taxes, you cannot be criminally charged. This means that in order to avoid conviction, you must have at least filed a return. John hires several criminal defense and tax attorneys to defend him and ultimately pleads guilty to tax evasion.

Both of these situations are detailed in California’s Revenue and Taxation Code, in Sections and 19705. Tax evasion is a serious white collar crime, which can carry jail https://simple-accounting.org/ sentences and hefty fines depending on the facts of the case. It can be prosecuted on the state level or the federal level, depending on which taxes are unpaid.

How Do You Get in Trouble for Tax Fraud?

Additional federal crimes include willful failure to file a return charged as a misdemeanor or conspiracy to defraud the government as a felony. Anyone who is facing one of these federal crimes needs a skilled tax evasion attorney to handle his or her case. Protect your future by calling Grewal Law PLLC today. Bey’s sentencing will be scheduled for a later date. He also faces a period of supervised release, restitution, and monetary penalties. A federal district court judge will determine any sentence after considering the U.S.

- You are entitled to a trial by a jury, or you can choose to be tried by the judge alone.

- Had Mr. Propstra consulted with a tax attorney with experience in defense of criminal tax matters prior to his arrest, some of the consequences of this crime might have been mitigated.

- As for Shakira’s fate, according to Abad, “from my experience, it’s just a matter of money.” He points to Cristiano Ronaldo, who previously faced similar charges.

- Falsifications on your federal return will impact your state taxes and could cause you to be charged with crimes at both the state and federal levels.

In contrast, an individual who is under criminal investigation could be facing serious jail time and fees if convicted of a charge. An individual can be charged with tax evasion when he or she intentionally avoids paying taxes legally owed to the government. At Grewal Law PLLC, we can handle any of your tax evasion cases including business investigations and criminal cases. It is the job of the IRS to pursue those seeking illegal profit by bending and breaking laws around employment tax, offshore taxes, money laundering, or foreign bank accounts. For those who would never dream of being involved in a criminal tax matter, a prison sentence sounds fitting.